Present value of lease payments excel

A positive value means the Difference is in favor of leasing while a negative value is in favor of buying. In this example it is 12 payments of 10000 occurring on the first day of each month starting on 2021-1-1 to 2021-12-1.

Using Excel To Calculate Present Value Of Minimum Lease Payments Thebrokerlist Blog

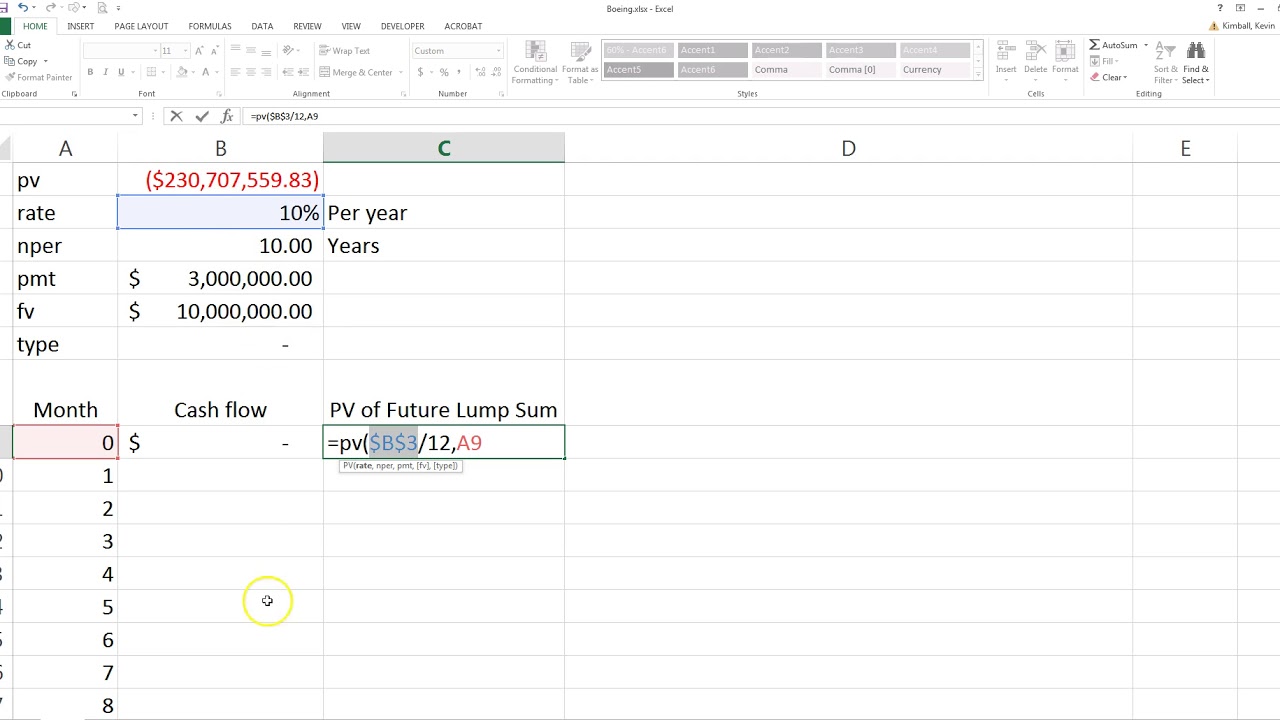

Present value PV is the current value of an expected future stream of cash flow.

. Initial direct costs paid in cash are CU 3 000. From a simple loan payment to a present value of an intricate series of irregular cash flows the calculation logic is built into the program. The template also features Taxation Data.

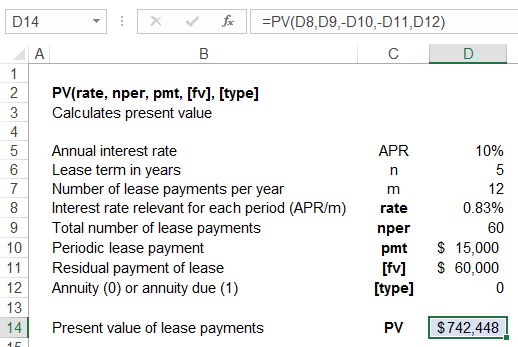

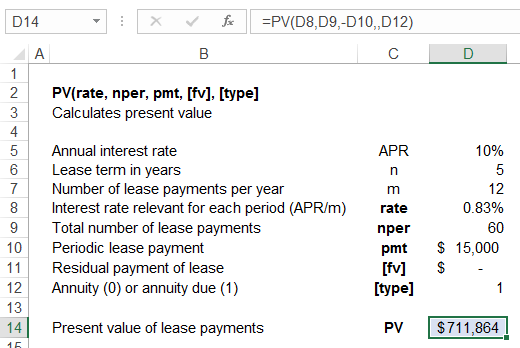

Pv required - the present value ie. If you would like more information on what payments should be included in the present value calculation for a finance lease refer here. Estimate risk in an investment and its hurdle rate as well as assess investment returns net present value internal rate of return accounting return Evaluate the right mix of debt and equity in a business and the right type of debt for a firm.

The payment of the related interest was CU 491. Taking the impact of the depreciated value the monthly lease payment Monthly Lease Payment Lease payments are the payments where the lessee under the lease agreement has to pay monthly fixed rental for using the asset to the lessor. Times the residual value percentage.

A lease is a method of financing the use of an asset and is an agreement between a lessee who rents the asset and a lessor who owns the asset. The present value of the lease payments is greater than or equal to 90 of the assets fair market value. Export amortization schedules to Microsoft Excel and Word and to PDF CSV and XML with one-click.

The equipment account is debited by the present value of the minimum lease payments and the lease liability account is the difference between the value of the equipment and cash paid at the beginning of the year. This lease is a finance lease for two reasons. Master excel formulas graphs shortcuts with 3hrs of Video.

The total amount that all future payments are worth now. Once these payments are present valued this will be the value of the lease liability. The repayment of the lease liability was CU 3 209.

It also creates a corresponding Lease Liability based on the same calculation. For example if you make annual payments on a 5-year loan supply 5 for nper. Fixed at 20 per year.

The term of the lease is greater than or equal to 75 of the useful life of the asset. Alternatively if evaluated under IFRS there is one more criterion that can be used to qualify a lease as a capital lease. Lease or solve any time value of money calculation Videos.

Sticker price MSRP of the car. Commercial Leasing The lease rate is primarily applicable for two. Go to Download Car Buy vs Lease Calculator for Excel.

During 20X4 ABC paid the lease payments in total amount of CU 3 700 thereof. Exhibit 3 shows the lease accounting. The lessor is usually a lease company or finance company.

Worksheet to compute net present value compare price and terms evaluate IRR. Present value of lease payments explained. Examine how much a firm should return to investors and in what form dividends versus buybacks.

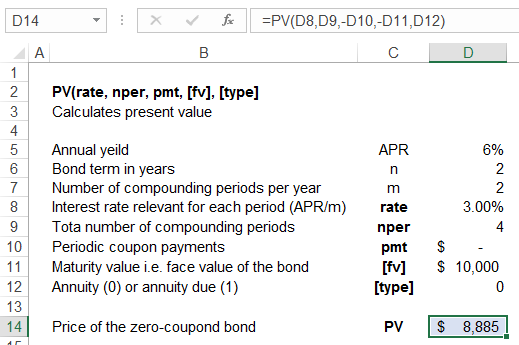

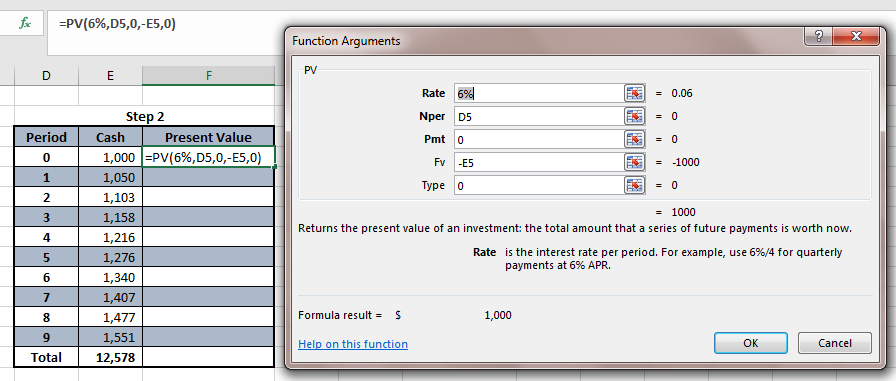

The formula for calculating PV in Excel. In case of a loan its simply the original amount. The present value of lease rentals is equal to or greater than the assets fair market value.

1 the lease term represents 100 of the useful economic life of the underlying asset and 2 the present value of the lease payments equals the fair value of the underlying asset. CR Lease Liability 136495. Lessee will record the fair value present value of min lease payments of the asset on lease at both the asset and liability sides of the balance sheet.

5 this is close to the rate the company would pay on secured debt. The rate of interest that at a given date causes the aggregate present value of a the lease payments and b the amount that a lessor expects to derive from the underlying asset following the end of the lease term to equal the sum of 1 the fair value of the underlying asset minus any related investment tax credit retained and expected. If you make monthly payments on the same loan then multiply the number of years by 12 and use 512 or 60 for nper.

How to Calculate a Lease Rate. Evaluates insurance payments and provides historical data useful when making crop insurance decisions for multiple crops. Negotiated selling price of car.

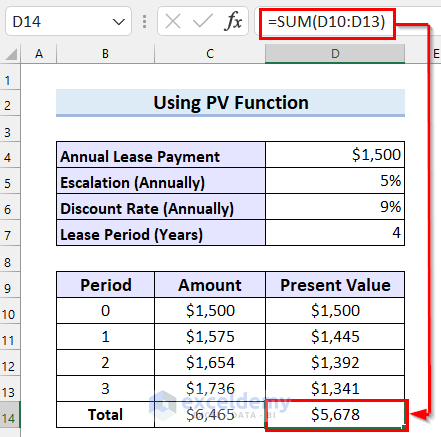

The lease payments due at Dec. FAST tools are a collection of installable Microsoft Excel Spreadsheets for a wide range of agricultural management and finance tasks. Under the new lease accounting standards lessees are required to calculate the present value of any future lease payments to.

The present value of the lease liability is CU 17 000. Initially the company creates a Lease Asset based on the Present Value of the lease payments over the next 10 years. Example of Lease Rate Calculation.

The calculator uses the monthly lease payments formula based on the present value of an annuity as follows. Present value commonly referred to as PV is the calculation of what a future sum of money or stream of cash flows is worth today given a specified rate of return over a specified period of time. Equals the residual value 13110.

In 20X4 amortization of ROU asset was CU 4 000. Present value can be calculated relatively quickly using Microsoft Excel. The TValue Family of Solutions.

At the end of the table you can see that the template automatically computes for the Difference with a Note to guide you.

How To Calculate The Present Value Of Future Lease Payments

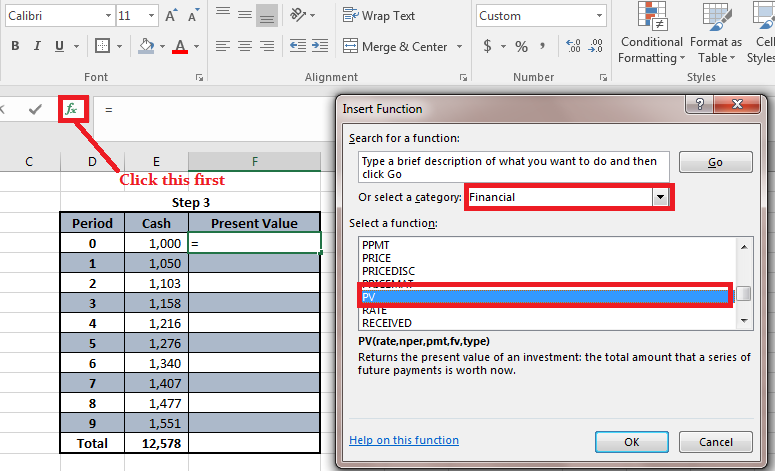

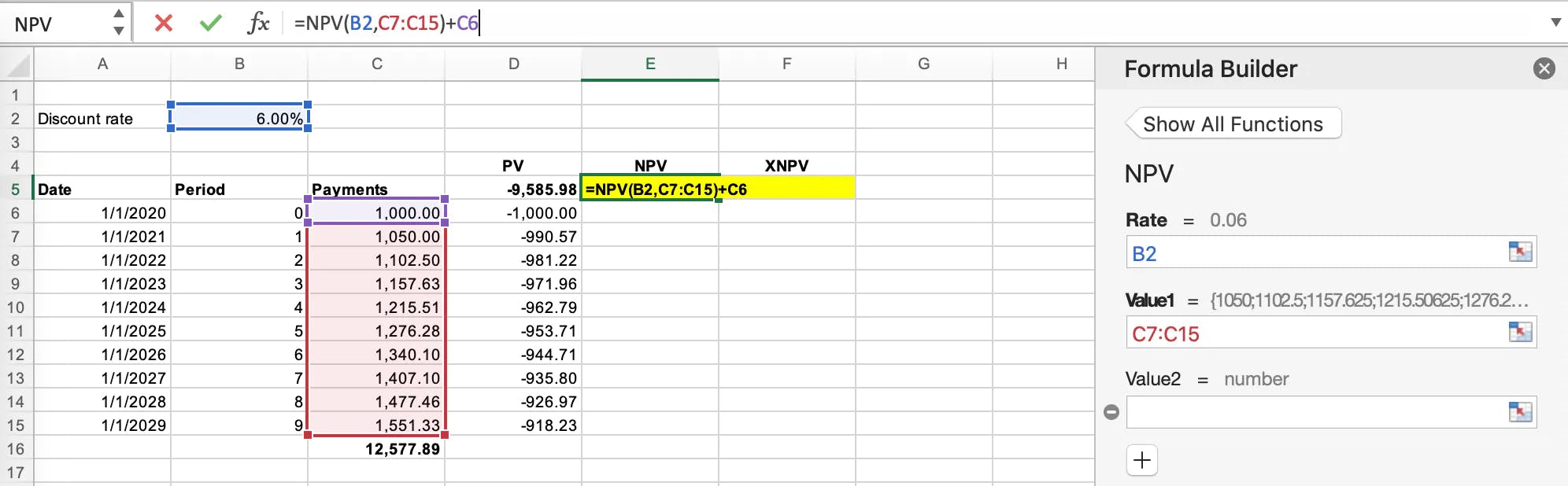

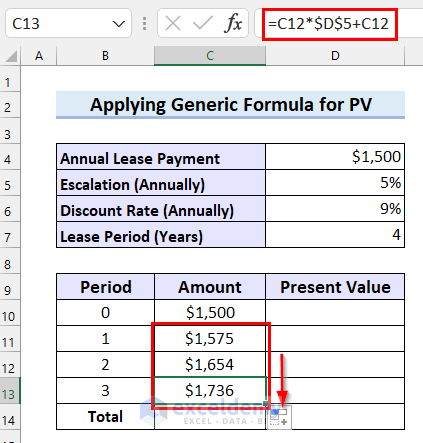

Calculating Present Value In Excel Function Examples

How To Calculate A Lease Payment In Excel 4 Easy Ways

Present Value Calculator Occupier

How To Calculate The Present Value Of Lease Payments Excel Occupier

How To Calculate The Present Value Of Lease Payments In Excel

Using Excel To Calculate Present Value Of Minimum Lease Payments Thebrokerlist Blog

Calculating Present Value In Excel Function Examples

Calculating Present Value In Excel Function Examples

How To Calculate The Present Value Of Lease Payments In Excel

Compute The Present Value Of Minimum Future Lease Payments Youtube

How To Calculate A Lease Payment In Excel 4 Easy Ways

:max_bytes(150000):strip_icc()/Clipboard01-618bfd11c29a4e2dbd2a50ea127f34d1.jpg)

Present Value Excel How To Calculate Pv In Excel

How To Calculate The Present Value Of Lease Payments In Excel

Using Excel To Calculate Present Value Of Minimum Lease Payments Thebrokerlist Blog

How To Calculate The Present Value Of Future Lease Payments

How To Calculate The Present Value Of Lease Payments Excel Occupier